Startup Watchlist: 9 Fintech Startups To Watch Out For In 2018

In India, the need for technological disruption in the banking sector is all the more acute, given that over 19% of the country’s population still remains unbanked. This is where fintech startups come in. Forecasted to cross $2.4 Bn by 2020, as per a report by KPMG India and NASSCOM, India is currently home to more than 500 fintech startups,whose collective aim is to attain financial inclusion. Since early 2015, the fintech sector has undergone massive changes, chief among them being the move towards a cashless economy.

The government’s enthusiastic promotion of cashless technologies – digital wallets, Internet banking, the mobile-driven point of sale (POS) and others – as well as the launch of IndiaStack including Aadhaar, eKYC, UPI and BHIM have also managed to restructure the financial sector, disrupting the long-held monopoly of traditional institutions like banks. Before we embark on an equally eventful journey in 2018, let’s take a look at the top nine fintech startups (which have raised less than $25 Mn in funding) that are a must watch in 2018.

Indian FinTech Startups To Watch Out In 2018

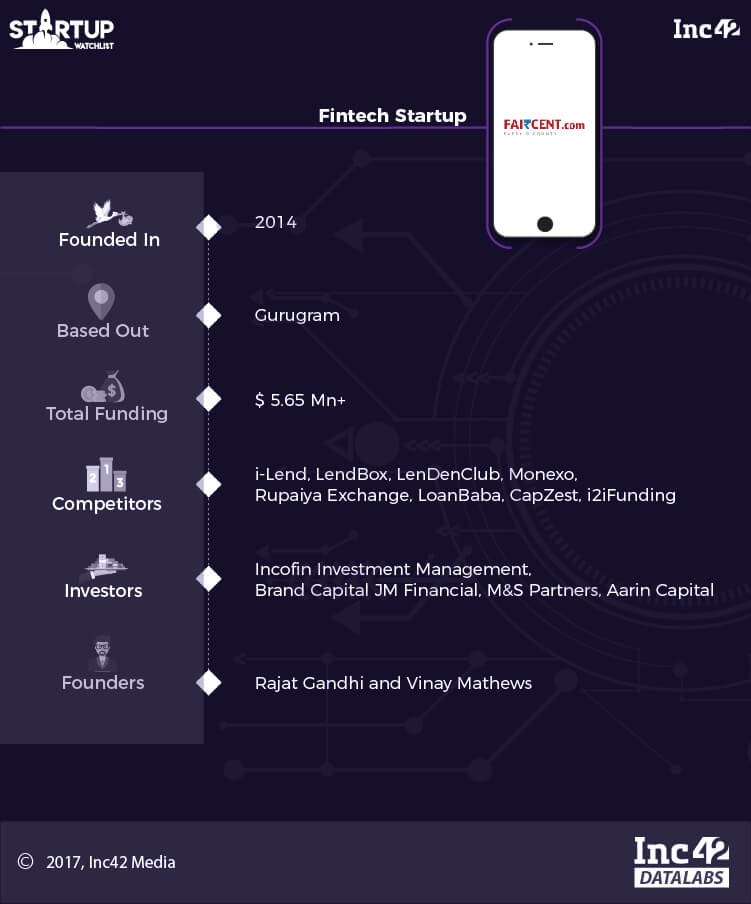

Faircent

Gurugram-based Faircent is a peer-to-peer lending startup that connects lenders with borrowers. Launched in 2014, the startup offers a variety of tools such as Auto Invest, which is a fully-automated feature that matches a lender’s investment criteria with the borrower’s requirements and automatically sends proposals to the borrower on behalf of the lender, based on pre-selected lending criteria such as loan tenure, amount, and risk profile.

Recently, the startup, under the trusteeship of IDBI, created an Escrow account for its lenders to help in faster and smoother flow of funds enabling them to make greater returns on their investments.

As part of a move aimed at diversification, Faircent introduced a semi-secure loan product in collaboration with Bengaluru-based micro-lending startups. The initiative was aimed at helping students avail fast and easy personal loans at a reasonable cost.

Till date, lenders on the platform have committed to lend over $4.8 Mn (INR 31 Cr), while borrowers have sought up to $3.5 Mn (INR 23 Cr) in loans. At present, Faircent claims to receive over 225K loan requests per month, with most of them being used for funding businesses, family events, appliance purchases, debt consolidation, among others.

Earlier, Faircent was showcased as one of the top startups at Start Up India, selected for the first batch of NASSCOM 10,000 and was also part of the Microsoft Accelerator Winter Cohort and BizSpark programme.

The Indian P2P lending industry has undergone a massive boom this past year, thanks in part to the RBI’s decision to regulate the space. Expected to hit the $4 Bn-$5 Bn mark by 2023, the P2P lending space is inhabited by some 30 players.

Riding on the ongoing fintech revolution, Faircent is gearing up to reach a larger group of people and businesses seeking capital that they can borrow online, without having to rely on an official financial institution as an intermediary.

Unlike most other players in the sector, the Rajat Gandhi-led startup has attracted substantial investor attention. Armed with a war chest of more than $5.65 Mn, how Faircent fares in 2018 will be interesting to watch.

Click here to read full story and more: https://inc42.com/features/startup-fintech-startups-2018/

Related Articles

-

Five things you should know before lending on P2P platform

Sep 05, 2018

-

Driven by Digital India and RBI guidelines, P2P lending is growing in India

Aug 01, 2018

-

Younger investors considering P2P lending

Jul 02, 2019