Investment Objective:

- The product attempts to generate superior risk adjusted returns by focusing exclusively on women borrowers.

- It presents a unique feature for lenders to invest passively in a mix of borrowers thereby diversifying risks without compromising on returns.

Product Riskometer:

This product is suitable for lenders who are willing to:

- Invest specifically in women borrowers

- Take moderate risk

Standard Exclusions:

Following borrowers are excluded from this product:

- Selected high risk profiles

- Poor credit bureau score or recent defaults

- Non-residents Indian

- Age less than 21 years or more than 55 years

- Borrowers without KYC documents

Product Performance Trend:

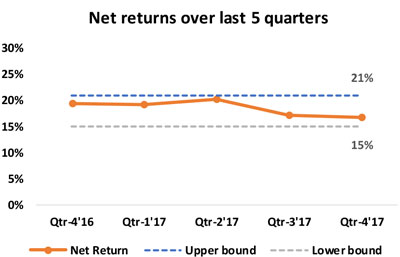

Women borrowers have delivered superior net returns (post default) consistently over the last 5 qtrs.

Released from January 2018

Presenting the "Aspiring Women" P2P Loan Product:

Our historical data clearly suggests that women borrowers are financially more disciplined. Hence, they make lucrative asset class for lenders to invest. Currently, approximately 10-20% of borrowers funded on our platform are women.

Product Summary:

- Minimum investment amount is ₹30,000/-

- Maximum investment amount is ₹10,00,000/-

To mitigate investor’s overall risk, Faircent will deploy this investment into various risk categories as follows. Also, investment per borrower will be limited to ₹1,500/- to ₹10,000/- depending on the borrower risk category.

| Minimal Risk | Low Risk | Medium Risk | High Risk | V. High risk | Unrated | |

| Distribution of investment | 0-10% | 10-25% | 10-30% | 10-25% | 5-15% | 0-10% |

Lock-in and Re-investment option:

The repayments from this product will be automatically re-invested for a period of 12 months and cannot be withdrawn for 12 months. Post 12 months, you have an option to continue re-investment or make monthly withdrawals.

Investment simulation:

₹ 1 lakh invested in this product will deliver the following returns over 18 to 24 months.

| Highest return% over last 5 qrtrs | Avg. return% over last 5 qrtrs | Lowest return% over last 5 qrtrs |

| ₹1,39,500/- | ₹1,34,000/- | ₹1,30,500/- |

Fees & charges:

| Investment fees | 1% of the investment amount |

| Collection / recovery fees | As per terms on Faircent.com |

Product Distribution:

Below charts give the distribution of all women borrowers on the platform on their bureau scores (based on their loan repayment history), their monthly income & their monthly fixed obligation to income ratio.