Portfolio What-if Analysis

Portfolio What-if Analysis (PWA) is a simulation tool that helps the investor better understand how a multi-loan portfolio operates. The investor can build different scenarios by varying number of loans, amount of the loan, rate of interest, tenure and start date; and study the impact on the returns of the portfolio. Each variation of the parameter has an impact on the return reported in terms of Net Annualized Rate (NAR).

Using the tool is a 3 stage process:

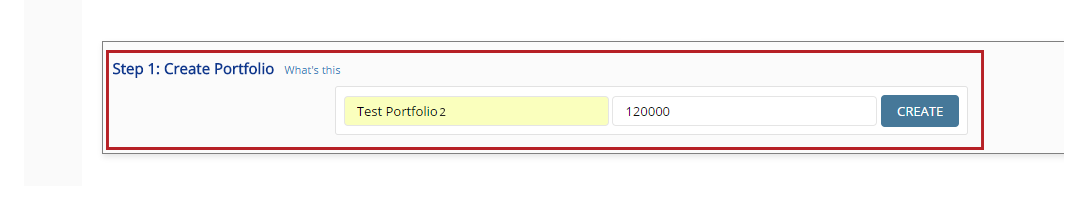

1. Create a portfolio

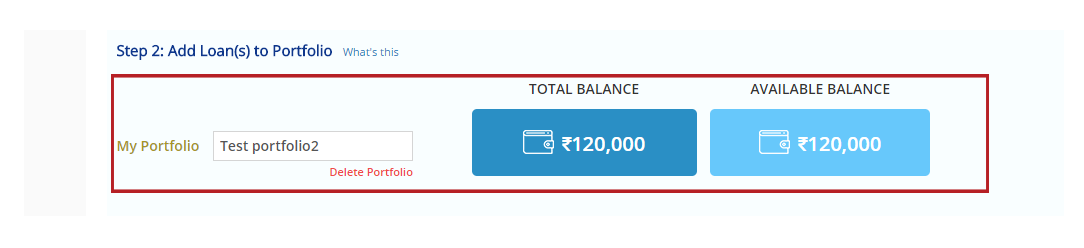

2. Add loans to the portfolio

3. Review simulation results

How to use the PWA simulator

Step 1: Under the Create Portfolio section, create a portfolio by giving a name to the portfolio. Specify the amount allocated to the portfolio. Since this is a simulator, you are not investing actual money in the portfolio.

Step 2: Under Add Loan(s) section, choose a portfolio from the list of portfolios already created. The Total Balance and Available Balance amounts will be displayed.

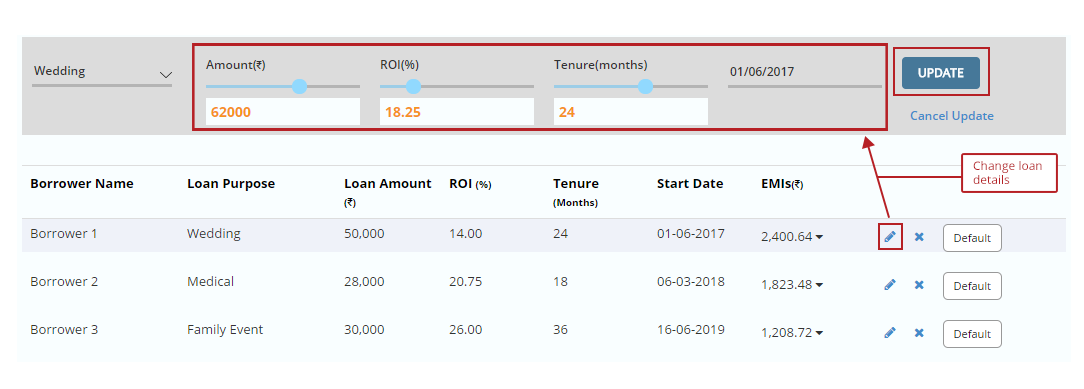

Step 3: Add a loan to the portfolio by selecting loan purpose, amount, rate of interest, tenure and start date of the loan. Amount of the loan will be deducted from the Available Balance. Repeat this process to add more loans to the portfolio. Loans can be added till the Available Balance is exhausted although you do not have to completely use up the Available Amount.

Step 4: Review the returns of the portfolio under the Review Simulation Results section. The section displays the Number of Loans, Total Amount Invested, Total Principal Received, Total Income from Investment, Lost Principal and Income, among other metrics. Changes in metrics can be studied by changing the as-of-date. Variation of NAR (Net Annualized Return) over investment period can be studied graphically.

Step 5: Mark some of the Loans/EMIs as default. Click on the default button against the loan you want to simulate as defaulted. A list of EMIs will open up. Click on the first EMI that will default. All EMIs following it will be marked as having defaulted. Click on Apply. The PWA simulator will perform calculations and present them under the Review Simulation Results. In case of loan default, you will find a drop in NAR where the loan has defaulted.

Step 6: Loans can be edited by clicking on the edit button (pencil icon) or can be deleted by clicking on the cross button. An entire portfolio can be deleted by clicking on Delete Portfolio.

You can create multiple portfolios for simulation purposes. Parameters such as amount, tenure, rate of interest, start date, default EMIs etc. can be varied to study the impact of each variation, in other words, the What-If scenario. Having a portfolio of multiple small amount loans will have a different impact of default versus a portfolio of fewer loans. NAR of a portfolio will decrease as the loans in the portfolio age.