P2P Empowering the Middle Class

The last couple of years have been tough for the Indian middle class. Economic slowdown coupled with ever rising inflation has squeezed the finances of every such household. The last couple of decades had witnessed a credit lead growth of the economy, where the availability of cheap credit helped fuel demand generation in the economy. Much of this demand generation was from the middle class which availed home loans, auto loans, personal loans, or relied on credit cards for pacing out their consumption needs.

The global financial crisis and the rising inflationary trend in the domestic economy resulted in the RBI adopting a high interest regime for over 3 years. This was a double whammy for the middle class, which suddenly faced the twin pinch of rising costs of consumption and rising costs of credit for consumption. Not only were newer loans now much more expensive to avail, but ongoing loan repayment burdens too were suddenly raised.

In the wake of these developments, debt restructuring has become important for most middle class households. While some struggle to squeeze out savings to make ends meet, the more industrious type are trying to restructure their debts so as to reduce the interest burden and protect their savings.

P2P platforms are one such option, and the service provided by Faircent is fast proving to be one of the top choices.

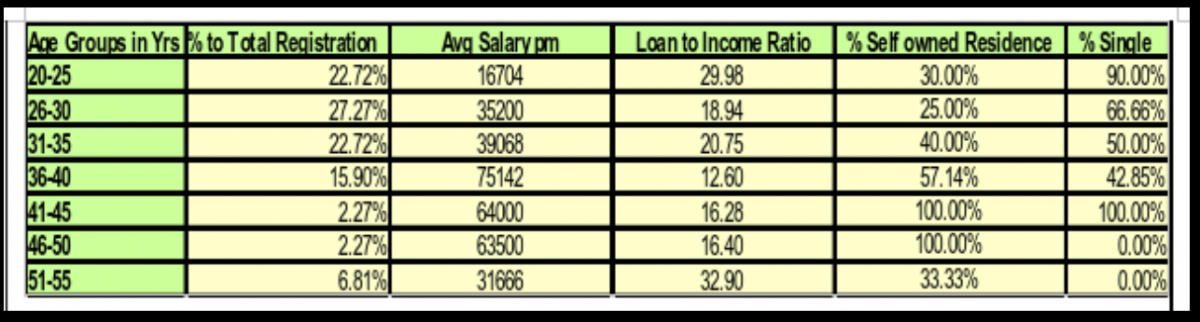

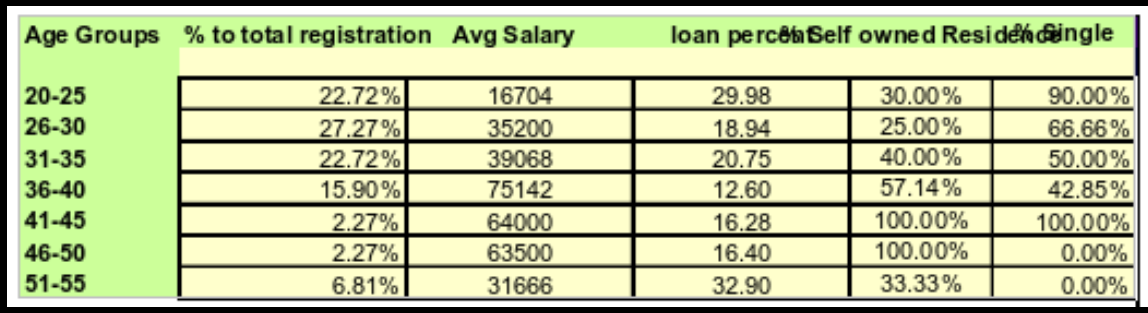

The borrower’s profile of Faircent gives a clear reflection of this fact. Majority of registered borrowers are in the age group 20-40 years, which is the early cycle of one’s career. The average salary range from Rs.16000-75000 denotes a middle class income group. A higher percentage in the age group 20-30 years is unmarried, while the higher age group of 30-40 years shows an even share of married and singles. The majority of them live in rented apartments. These are typical profiles of the middle class aspirants planning to settle down and establish a foundation for their future. For the higher age groups, the percentage of home owners and married borrowers rise proportionately, with average salaries well within the middle income range.

Most of the borrowers cited debt restructuring as the prime reason for borrowing. The loan percent (total loans sought as percentage of annual income based on declared salaries) for most age group show that the amount sought are not very high proportions of their total incomes. This means that most of them are not borrowing under destitute conditions or are possibly over leveraged. They are simply trying to shift their loan burdens from high interest commitments (possible to conventional financial institutions) to a lower interest commitment, in order to lower the total debt burden.

This is where the real benefit of Faircent as a P2P platform lies. It offers borrowers the flexibility to negotiate lower interest rates and reduce interest burdens on their loans. This is a boon for the middle class, as it helps lower their debt burdens while at the same time provides them with cheaper loans to manage expenses in times of high costs.

The global success of P2P platforms has been on the basis of its popularity amongst the hard hit common man across the world, and Faircent is providing the same relief to their Indian counterparts.