Panel suggests sweeping changes to bring India at par with fintech rise

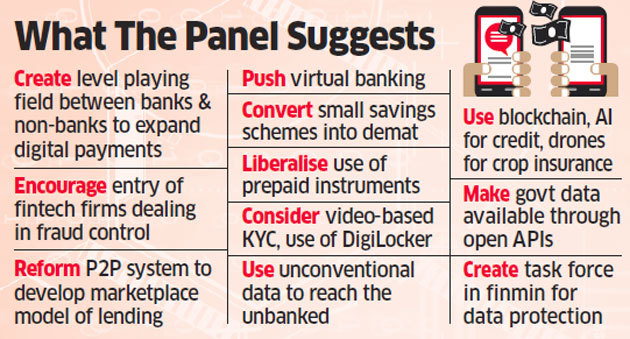

A high-level panel on fintech has made wide ranging recommendations in its report - for development of a marketplace model for peer-to-peer (P2P) lending, virtual banking to allow lenders to operate without branches, use of drones for field assessments and artificial intelligence (AI) to reduce frauds. This panel, headed by the DEA Secretary, submitted its final report to the Finance and Corporate Affairs Minister Nirmala Sitharaman on Monday, September 2, 2019.

Read more details at:

https://economictimes.indiatimes.com/news/economy/finance/fintech-panel-suggest-legal-framework-to-protect-digital-services-consumers/articleshow/70948757.cms

https://economictimes.indiatimes.com/news/economy/finance/fintech-panel-suggest-legal-framework-to-protect-digital-services-consumers/articleshow/70948757.cms

Related Articles

-

Faircent gets $1.5 million funding from BCCL’s Brand Capital

Aug 11, 2016

-

Thrive with Crowdfunding

Apr 30, 2020

-

RBI likely to issue clarifications on P2P lending norms soon

Nov 17, 2017