The Evolution of Lending System – The Real Story

The practice of lending and borrowing is as old as the invention of money. The history of borrowers, lender shows the stringent lending rules existed as early as 2500-2000 BC during the Sumerian civilization, pre-dating ancient Greece and antediluvian Rome.

It is amusing to envision how individuals in early civilizations did their financial or economic transactions? and what for?

To purchase grain from the market? livestock? textiles? craftsmanship? or slave exchanges? No matter what, certainly, the habits do gets inherited since the needs of early civilizations weren’t much different from ours. So, this practice of lending has survived and continued till this modern day. The banking as a concept first time started in the 8th century B.C.E. from the Mesopotamian civilization.

Here is an evident look back!

*The House of Egibi [1]

The House of Egibi was one of the few first families involved in trading activities. The quasi-banking families!

A Brief Prologue -

It was the time when Babylon was at war with ancient Egypt… The Nebuchadnezzar II (the greatest king of Babylon) formed his military by offering land to the people. What he got in return is the enormous manpower, to create a dreadfully strong army to attack and conquer the regions around. As a result, a serious need of farming the land was brought up in ancient Babylon. This is where the House of Egibi came in. They profitably accomplished the role of property management during the reign of Nebuchadnezzar II. As a result, the men who owned the land went to battle in the military for Nebuchadnezzar's purposes. [2]

As we further dig into the Babylonian archaeological records from the 8th century B.C.E., they showed the name of house existed at a time beginning sometime during Neo-Babylonian and old Persian era.

This family was not just locally based; however, it was actively present all over Babylon, even internationally. [3] The activities of families were not of the banking proper since they did not participate in arbitrage. The system was just of accumulation of wealth.

They were involved in selling, buying and exchanging of fields. They acted as creditors and also accepted deposits for the safekeeping.

*The Ancient Rome - Temple as a “Bank”

As incredible as it may sound, in ancient Rome the temples were the 1st ever banks in the world. They served the purpose of a sanctuary where individuals could make deposits in the form of gold, silver, valuable gems and ornaments. These sacred sanctuaries offered the highest safety to safeguard the deposited wealth of society.

In addition to safekeeping, the archeological records from the ancient Roman temples confirm that temples even loaned money out to individuals in need of farming land, cattle or any other day to day necessities. They were an important center where commodities such as crops, daily uses commodities, and precious stones were banked and redistributed among the communities.

Since they were the earliest financial centers of their first cities, it could also be the major reason that they were robbed during wars.

For Example, the Temple of Saturn, built in honor of Greek god - Saturn; housed the initial public ‘treasury’ – The Aerarium.

The treasury encompassed the monies and accounts of the various state finances. These public treasures were deposited in the temple of Saturn, they were under the supervision and control of the Senate. It also held the public decrees engraved on brass, the judgments of the senate and other documents and records of notoriety.

The ruins of temples of Saturn in present-day can be seen in the western end of the Forum Romanum, on the foot of Capitoline Hill, it is one of the seven hills of Rome. [4]

So, it was in the temples of Rome, that the earliest banking industry of the world developed and the notions of safeguarding of the deposits took place. They perfected the administrative aspect of banking with better regulations and stringent financial practices.

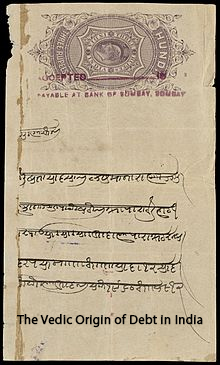

*Rina – The Vedic Origin of Debt in India

It is during the times when Rigveda was scripted, the term Rina meaning ‘debt’ was coined. Other terminologies such as Rinapatra, Rinalekhya, Kusidin (“usurer” or “soodhkhor”) etc. often found in the Manusmiriti and has its reference in Bhagwad Gita, Sutra [700-100 BC] and Kautilya’s Arthashastra.

The very first sentiments of disdain for usury (lending with very high interest) are expressed in Hindu scripture ‘The Sacred Laws of the Aryas’.

For example, Vasishtha, one of the most revered Vedic rishis of that time, made a special law (Vasishtha, The Sacred Laws of the Aryas, Part II, Chapter 2, vs 40-42) which prohibited the higher castes of Brahmanas (priests) and Kshatriyas (warriors) from being usurers or lenders at interest. [5]

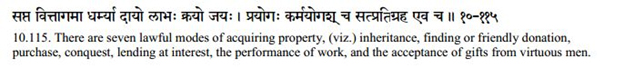

Manu Smriti 10.115. There are seven lawful modes of acquiring property, (viz.) inheritance, finding or friendly donation, purchase, conquest, lending at interest, the performance of work, and the acceptance of gifts from virtuous men. [6]

We all know that modern banking in India began after the rise in power of British, however, the early evidence regarding the existence of money-lending operations can be traced from the literature of the Vedic times, i.e., 2000 to 1400 B.C. Here it can be concluded that the Europeans are not the founders of banking in India. The lending and borrowing regulation had a rich tradition and greatly evolved with the time.

1- Kautilya’s Arthashastra [400 BC]

Kautilya, also known as Chanakya is the India's most prodigious political economist during the Maurya dynasty (321 to 185 BC). The Kautilya’s Arthashastra is an ancient Indian treatise which covers the detailed references on creditors, lenders, lending rates and the existence of professional banking in India.

It clearly mentions the presence of financiers or merchant bankers during Maurya era. Also, there was a financial instrument called “Adesha”, which are comparable to Bill of exchange of current times. [7]

In fact, the classic ‘Arthashastra’ showcases some special norms for banks going into bankruptcy. If anyone became bankrupt and debts owed to the Kingdom, the Arthashastra permitted to employ all means, fair or foul, to recover the dues.

Chanakya said that -

“Sons should pay with interest or the debt obligation of a deceased person or co-debtors or guarantor. Was a spouse, i.e., husband or wife responsible to pay for the debts incurred? Yes, and no. Wife was pardoned from debt load of her spouse if she had not given her agreement to his borrowings. However, for the debt incurred by a wife, her husband was accountable for debt repayment”.

2- Hundis – A Principal Instrument of Credit in Medieval India

In India, the indigenous business houses or bankers have been historically using some kind of Bill-like instruments written in innumerable vernacular languages, known as ‘Hundis’. [8] Various written records are present disclosing their practice at least as far back as the 6th century, mainly to repay and receive the value of goods bartered in the course of trade. They had many variants such as Sahyog Hundi, Darshani Hundi, Muddati Hundi, Nam-jog hundi, Dhani-jog hundi, Jawabee hundi, Jokhami hundi, Firman-jog hundi etc.

In India, the indigenous business houses or bankers have been historically using some kind of Bill-like instruments written in innumerable vernacular languages, known as ‘Hundis’. [8] Various written records are present disclosing their practice at least as far back as the 6th century, mainly to repay and receive the value of goods bartered in the course of trade. They had many variants such as Sahyog Hundi, Darshani Hundi, Muddati Hundi, Nam-jog hundi, Dhani-jog hundi, Jawabee hundi, Jokhami hundi, Firman-jog hundi etc.

During the colonial era, the British government regarded the Hundi system as homegrown or customary remittance system, but not informal. They were disinclined to intrude with it as it modeled an important part of the Indian economy. Hundis greatly points towards the legal and economic culture of the Medieval period.

Later during the middle ages and Mughal period, there was a decline in banking. Taking interest was considered a sin in Islam. Some countries even prohibited their citizens to establish a bank.

Of course, some people were still doing it.

SOURCE: Wikipedia [https://de.wikipedia.org/wiki/Hundi]

*Italy – The Birthplace of Modern banking

If we go purely by the present-day banking conventions, it would be safe to say that Italy was its birthplace. The story of lending and borrowing revolves around the trade partnership between the Italian grain merchants and the Jews in the Maritime Republics.

Jews originally developed practices now considered common in merchant banking to finance their travels. They originally lived in Muslim Spain. Others had lived in England prior to the genocides of Jews in London and York in 1189–1190. Before the Law of the Jewry passed by Edward I of England in 1275, some Jews also traded in the far east on the silk road.

They took their banking practices to the Italian trading centers, where they were forced to live in Jewish Ghettos (a part of a city, a slum area, occupied by a minority group) in Italy. Here they started working with already established Italian grain merchants, merchandising centers, and their non-interest charging mercantile banks, which were the first merchant banks in modern history, old Roman banks aside.

Trivia: In the Middle Ages in Italy, money lending was done on the Italian trading streets, on the bench, which on Italian is called “banco”, and hence came the name "bank". Likewise, “bankrupt” is a corruption of the Italian Banca rotta, or broken bench, which is what happened when someone lost their traders’ deposits. Being “broke” and “bankruptcy” has the same connotation.

Moving forward, after some progression under Medici family starting in the 1400s, these non-interest charging “banks” evolved into our modern-day banking system.

1- The House of Medici [13th Century]

The House of Medici had a powerful influence in European history. In the late 14th and 15th century the family truly came to power with the creation of the Bank of Medici. Giovanni de’ Medici opened up one of the first family banks in 1397 in Florence. [9] They were much-acclaimed for their banking expertise and are synonymous as a sovereign patron of the arts during the Italian Renaissance.

The Bank of Medici operated branches all over Western Europe, Rome, to even Barcelona and London. They expanded their banking activities at an extraordinary pace financing the trades and the extravagances of princes, popes, and lords.

Throughout the years they saw their fortunes grow through a variety of ventures. During this period of banking dominance, the Medici’s utilized several banking innovations which are still in use today. Mentioned below are some of the banking innovations commercialized by this renowned bloodline in their peak of your success -

2- Double-entry bookkeeping

For accurate bookkeeping and to minimize errors Medici needed a much systematic method. So, they utilized the double-entry bookkeeping method where the accounting equation of “Assets = Liabilities + Equity” was put to use. It means that both debits and credits are recorded. It was helpful to create an overview of a business account and helped merchants to keep a better eye on their accounts. This simple yet highly effective method is still followed in modern banking giving banks the reputation for reliability.

For this, we are grateful to the House of Medici!

3- Letter of credit

As the ship sailed and caravan wheeled the international trade started to flourish by means of silk route in the 15th century. So, the Letter of Credit came in use by the traveling merchants. It used to be a simple agreement that authorized a buyer bank guarantees to pay the seller’s bank when the goods were delivered.

Medici’s were smart, yet shrewd bankers. As we know that during those times the usury was a cardinal sin, a letter of credit became one of a meaningful way to cover the interest within the transaction. Thus, refrained theocracy from getting angry.

4- Holding companies

Although it is not strictly a banking innovation, the Medici family introduced the first model of a modern holding company. They had a wide and extensive network to branches across Milan, Venice, Rome, London, Geneva, Lyon, Avignon, Barcelona, and Bruges. Each of its branches was a partnership, held under the central holding company in Florence. This helped them to develop the innovation of letter of credit and bills of exchange, hold deposits, make loans and ultimately solidified their presence and trust across Europe, as global banks of today.

The Medici’s lust for wealth, power, and patronage forced them to go through a tumultuous time by the end of the Renaissance in 1494. They were mainly lending to royalty, to finance military campaigns or lavish princely lifestyles. Due to lack of strong succession, aristocratic pretensions, and frivolous lending practices, the Medici Bank went bankrupt and was forced to close all its branches.

Nonetheless, the House of Medici represents one of the early examples of capitalist families.

*The Birth of Currency

As trade between the various nations gradually began to expand, international trade became a necessity. The bartering was too slow, too impractical and sometimes impossible. Back to Babylonians, they use to trade on items that were universally desired, easily divisible and effortlessly portable as a sort of money.

So, they relied on Gold. It was hard to produce, rare metal, durable and portable. They had faith that everyone would accept it.

Thus, giving birth to money!

Of course, there were other types of currency in other parts of the world too, such as metal rings, stone rings, shells, beads, furs, skins, salt, whale’s teeth, cartridges, bullets, tobacco. But no matter what culture it is, every individual wanted to increase his stock of currency faster, so he can exchange it for things he essentially wants.

Obviously, money itself is undoubtedly not a wrong concept. It is an important medium of exchange. So, like everything else man has gotten his hands on, it has become thoroughly corrupt.

1- Goldsmiths of London [10]

Fast forward to the 17th Century in London, the practice of issuing banknotes was slowly emerging….

The goldsmiths of London developed banking in its modern form by uniting various business activity functions such as: maintaining facilities to store gold, silver, and bullion in safe vaults, deposits and loaning out deposits (as well as their own money); trading in foreign exchange; and discounting bills of exchange. They also became the dealers of foreign and domestic coins.

They used to maintain the running account of each depositor’s assets. This way they conducted a profitable business. Before the goldsmith bankers, these activities were on the sidelines or by-products of other trading activities.

The paperwork of these activities laid the foundation of modern banking innovations. The banknote (precisely the paper money) evolved out of receipts for deposits at Goldsmiths. These receipts soon became negotiable like sanctioned bills of exchange.

Modern banking began when these receipts instead of bearing the name of a particular depositor or borrower, got printed as to the “bearer.” Thus, the modern banknote came to life with the Promissory Notes Act of 1704 approving the practice of accepting notes in exchange.

*The First Modern bank

At the beginning of the 17th Century, the Bank of England became the first bank to issue permanent banknotes. These were firstly handwritten and issued on deposit or as a credit. They would pay the bearer the value of the note on demand. By the 18th century, the Cheques were widely in circulation and forever changed the way money was traded.

Trivia: The British word “cheque” came from the exchequer, the British term for “treasury.” The cheques were named after the Exchequer (banks) orders to pay. The first cheques were called drawn notes and later evolved to bills of exchange and were called notes or bills.

*The Rise of Technology – Credit Cards to Payment Wallets

With the rise of computers and the development of faster communication channels banking organization witnessed a dramatic increase in size and geographical spread. Computers provided better data handling, fraud detection and reduced the time required for gathering customer data. The technology has completely altered the way finance industry works that have made the cheques somehow irrelevant. We all have credit cards and debit cards in our wallets.

In 1946, the Biggins’ bank first introduced the Charg-It card. It acted as the middleman that balanced the payments from the customer and traders in a “closed-loop” system. Every transaction on Charg-It was forwarded to Biggins’ bank and only bank customers were authorized to use the Charg-It card within their local region.

It was in 1950, the first version of a universal credit card was introduced by The Diner’s Club Inc. Their function was to create customer loyalty and experience. It was technically a charge card, meaning the bill had to be paid in full at the end of each month, however, the credit of introducing the first credit card goes to Diners’ Club.

Similarly, American Express Company in 1958 introduced another notable card of this type, known as a travel and entertainment card. This helped merchants throughout the world to pay for the good/services on credit cards. Sales slips were add-on innovation in the bank credit card system.

In 1966, with the formation of interbank associations MasterCard and Visa, general purpose credit cards were born, and in 1969 the first Automatic Teller Machine (ATM) debuted in New York at Chemical Bank. This technology revolutionized the banking industry. Now customers no longer had to visit a bank for basic monetary transactions.

In 1944 with the rise of the internet, came electronic fund transfers and online banking. Early adopters saw the benefits of it straight away, but many customers remained hesitant due to lack of trust on the online security features.

However, all thanks to e-Commerce the online banking became mainstream in the 2000s, to offer online products and services. Ultimately, strengthening the legitimacy banking for consumers. The 2000s also saw the rise of online payment wallets in the form of mobile apps such as PayTm, PayPal etc. They served the quick online payment purpose for online merchants, sale websites and other commercial operators. Millennials are routinely paying each other or making purchases with such apps. All of these Fintech companies are strong contenders who are increasing their market share and competing with retail banking services.

Banks have come a long way from the temples of ancient Rome to the payment wallets of the modern times. However, their basic occupational practices remained unchanged - To issue credit at interest and protect the depositors' money.

The financial crisis of 2008 is still fresh in the memory of people, crushing the confidence of millennial’s in the traditional form banking system… In the bracing of tomorrow, there is a need for constant innovation in retail banking for banks want to remain relevant in this digital economy.

*The Peer to Peer Lending – A Banking Substitute

No branch visits, far fewer staff, capital-light model and far greater automation - The Peer to Peer lending or simply P2P lending is an evolved version of conventional banking.

It first emerged in 2005 when Zopa, was set up in the United Kingdom offering exact same banking services (credit and Online Investment) at rates better than banks.

With zero banking mediation, P2P Lending platforms connect lenders directly with borrowers. They facilitate an online credit marketplace with a full range of loan products and investment opportunities, along with superior customer engagement.

Through their proprietary loan underwriting expertise and highly advanced machine learning & data analytics techniques, these online credit marketplaces have already brought some major fundamental changes in the Credit risk evaluation process. Now, the interest rates on Online Loan can be negotiated between the lenders and borrowers, resulting in far attractive rates for both the participating parties.

The P2P advantage is obvious!

References:

https://en.wikipedia.org/wiki/House_of_Egibi

https://www.ancient.eu/article/636/temple-of-saturn-rome/

https://rbi.org.in/Scripts/ms_hundies.aspx

- Log in to post comments

Related Articles

-

Small businesses prefer digital loans over banks

Nov 21, 2019

-

P2P and Small Business: Bringing Crowd-funding to India

Mar 28, 2014

-

How Online Personal Loan for Diwali Festival can Brighten up your Home?

Oct 17, 2018