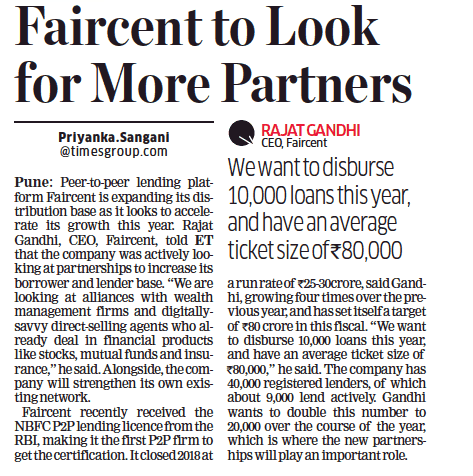

P2P lending platform Faircent to look for more partners

Peer-to-peer lending platform Faircent is expanding its distribution base as it looks to accelerate its growth this year. Rajat Gandhi, CEO, Faircent, told ET that the company was actively looking at partnerships to increase its borrower and lender base.

“We are looking at alliances with wealth management firms and digitallysavvy direct-selling agents who already deal in financial products like stocks, mutual funds and insurance,” he said. Alongside, the company will strengthen its own existing network.

Faircent recently received the NBFC P2P lending licence from the RBI, making it the first P2P firm to get the certification. It closed 2018 at a run rate of Rs 25-30crore, said Gandhi, growing four times over the previous year, and has set itself a target of Rs 80 crore in this fiscal.

Related Articles

-

Poor credit score stopped your loan from going through? CreditMantri can help you set it right

Apr 21, 2016

-

P2P Lenders Fear Strict Regulations May Hurt Business

Apr 25, 2016

-

Fintech firms to take profit-first approach, say panellists at VCCircle summit

Jul 30, 2016