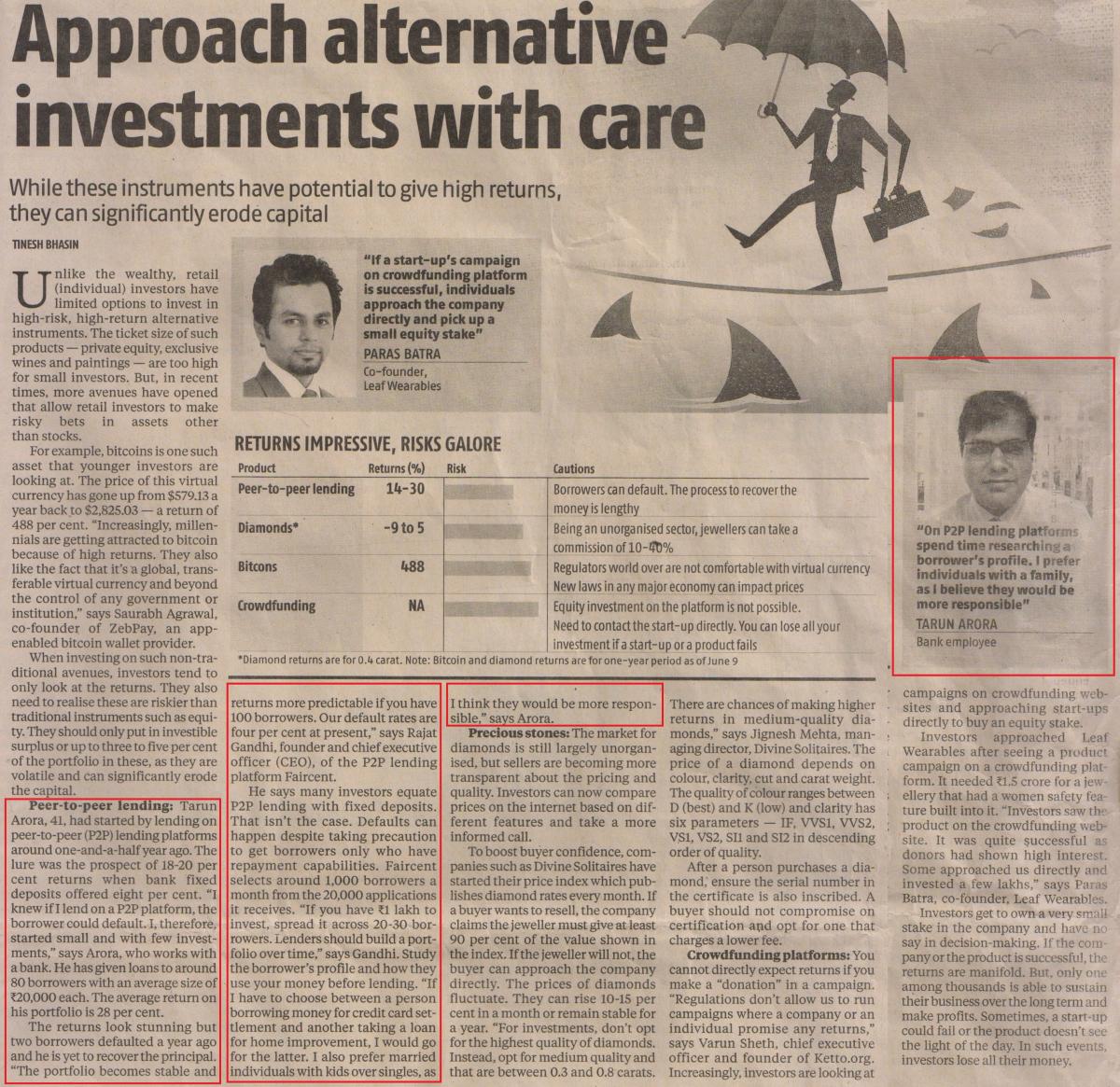

Approach alternative investments but with care

Unlike the wealthy, retail (individual) investors have limited options to invest in high-risk, high-return alternative instruments. The ticket size of such products — private equity, exclusive wines and paintings — are too high for small investors. But, in recent times, more avenues have opened that allow retail investors to make bets in assets other than stocks. One such new emerging asset-class is P2P lending.

To read at source click here http://www.business-standard.com/article/pf/approach-alternative-investments-with-care-117061100791_1.html

Related Articles

-

5 FinTech platforms to revolutionize business in India

Oct 16, 2017

-

P2P lending: Finding the right balance

Jun 21, 2016

-

Ra-Ra Year For Retail Loans

Dec 27, 2016