Easy access to credit: Challenges faced by SMEs and Micro SMEs

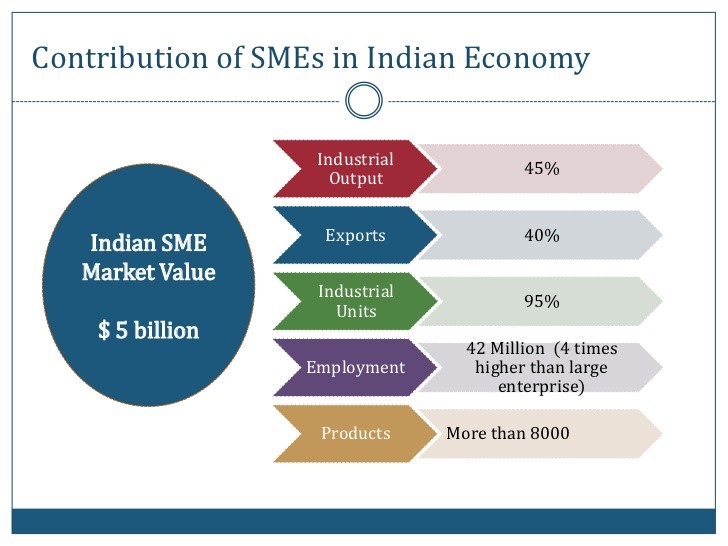

When it comes to contributing to the economy – Micro, Small and Medium Enterprises’ (MSME) – boast of significant potential, both in context to the generation of employment opportunities and contribution to GDP. They are offering volume to the Indian industry base, fostering new entrepreneurship, contributing to national output, and adding to the export figures of the nation.

In recent years, this sector has been weaving some of the most inspiring success stories of India. In fact, MSMEs are accounting for 46 % of the industrial production and 95% of the total industrial units; they are the largest employment providers with over 6 corers of the Indian population depending on them for livelihood.

Quick finance and easy access to loans or personal loans serve to be the primary critical growth drivers for the growth of Indian MSMEs; this is because most businesses in this sector trigger off their operations with minimum capital. However, the lack of adequate and easy access to business loans has emerged as a major obstacle for their growth. From inefficacy of measures in credit flows (such as credit scoring for SMEs) to information asymmetry faced by banks and financial institutions, there are plentiful challenges that have impacted the contribution and performance of small and medium enterprises in the Indian economy. More than 80% MSME entrepreneurs have to resort to other avenues of financing, such as peer-to-peer lending, to obtain credit assistance. On Faircent, personal loans to fund business expansion is the second largest loan purpose stated by borrowers.

In most cases, transaction lending and access to credit pose strong challenges because of:

- Inadequacy of ‘soft’ and ‘hard’ information,

- Relationships of SMEs with banks,

- Availability of low credit facilities because of the origin and size of banks,

- Long-drawn decisions on credit financing for SMEs and delays in fund disbursement,

- A specific bias against smaller-sized loan portfolios,

- Cumbersome processes and non-task oriented structures of Indian banks,

- The requirement of complex collaterals for obtaining term loans- even at very high rates,

- Difficulty in obtaining Private Equity Funding,

- Non-standardized project appraisal systems for term loans, etc.

In the given scenario, SMEs and micro-businesses are looking for easy, affordable and quick funding opportunities for setting up their operations. The borrowers in this segment belong to different towns and cities of India and desire to obtain convenient credit access to start their showroom, clinic, restaurant, e-commerce business, franchisee, store, or other commercial establishments. They have limited working capital, insufficient collaterals, and inadequate credit scores to bank on. These factors make it all the more difficult for them to avail term loans from financial institutions. What’s the way out?

Peer-to-Peer (P2P) lending often serves as a long-term solution for the capital requirements of such SMEs. P2P lending in India generally operates online, wherein marketplace like Faircent introduce SME borrowers directly to a wide range of investors and lenders. For instance, the financial experts at Faircent screen SMEs for quality and provide their information to a vast pool of lending resources (currently, more than 6000 registered lenders have pledged more than Rs. 11 crores to fund 26000 registered borrowers with demand totaling to Rs. 7.7 crores approx. on the platform). Once the documentation and other nuances of borrowing are confirmed, the lenders registered with Faircent release funds to SMEs in the form of personal loans or business loans across a widely spaced risk basket – typically, low risk (12-14%) to high risk (26-30%) loans.

SME Business Peer-to-peer - Features & Benefits

Today, easy business loans are being offered to SMEs via technology-backed peer-to-peer lending platforms to help them generate more capital and better growth opportunities. P2P personal loans and business loans are way easier and faster!

- In general, these loans have flexible timelines (at Faircent, the loan tenure stretches from 6 months to 36 months) for the repayment of forecasted loan amounts.

- Loan approvals are also on the basis of current/ future cash flows and not based only on the historic financial statements of SME businesses.

- The in-house technology platforms and modern underwriting approach of P2P lending agencies ensure that money flows into the accounts of credit worthy borrowers in just a couple of days.

Even though the P2P industry is in its infancy stage in India, it’s a matter of time before it will start competing with its counterparts in more mature economies. This alternative method of financing is here to stay. It is fast becoming the answer to the many challenges of easy access to credit in the Indian economy – especially for SMEs and micro-businesses.

Are you also looking for tailor made credit solutions for SMEs? Sign up with Faircent at the earliest. Because every % counts.

Reference URLs:

http://www.iibf.org.in/documents/reseach-report/Report-30.pdf

http://www.ijstm.com/images/short_pdf/1457509568_729H.pdf

http://www.ijsrp.org/research-paper-1214/ijsrp-p3614.pdf

https://fundingsocieties.com/blog-detail/33/how-peer-to-peer-lending-can-help-smes

https://www.capital-match.com/borrow.html

Related Articles

-

P2P Loans Successfully Substituting Bank Loans

Jul 06, 2018

-

Why You Really Need a Good Credit Score?

Oct 03, 2018

-

How borrowers are exploited by banks

Oct 16, 2017