Wedding Season: Time for a funds planner?

The wedding season is here, along with it mirth and merriment. It also brings in its wake the need for purchase, be it jewellery, trousseau, gifts, goodies or cosmetics. Many also feel the need to jazz up their homes and spruce up what’s on display at the home front.

Additionally, some new-age couples taking the plunge also want to make a big splash. From hosting websites to pre-wedding shoots, fancy invitation cards, accompanied by imported chocolates and champagne, to exotic and innovative backdrops, weddings have truly become a grand affair.

And if you thought it was just the wedding rituals that needed money, think again. Post-wedding, gigs, known as the “honeymoon”, too, have also become a fancy deal. From the Swiss Alps to checking in at one of the more expensive hotels in Europe, there’s no stopping the newly-weds.

Except for one thing: Funds

Whether it is for your sister or brother or yourself, a wedding in the family means expenditure. While Indian families are notorious for saving for weddings the last mile is always a challenge.

So, where does one turn to for that extra funds?

Banks do not provide separate “Personal Loan for Marriage”. Instead, they disburse funds through a Personal Loan, at an interest rate that ranges between 16% to 36 % inclusive of processing fee and dependent on credit-profile of the borrower.

However, an alternative is to sign up with a Peer-to-Peer loan or P2P loan facility like Faircent which promises fewer restrictions and lower P2P loan rates by reducing intermediary cost. It brings the borrower in direct contact with lender. The whole process is tech-enabled and requires least human interface thus making it faster, smoother and more cost-effective.

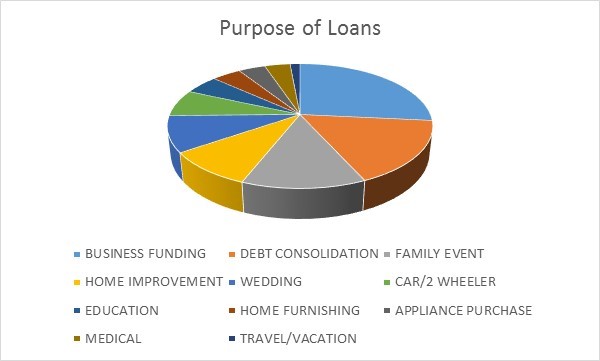

Wedding personal loans continue to be one of the top reasons that makes borrowers turn to Faircent.com in India. Almost 9% of disbursed personal loans in India over the last 20 months have helped finance weddings, across metros and tier-2 towns. We have borrowers using these funds for their own wedding or for arranging their sister’s wedding. P2P Loan tenure extends from 6-36 months and interest rates start at 12%. So sign up now! Because every % counts.

Related Articles

-

Tip to get the best deal on your car loan

May 19, 2016

-

P2P lending: How to Get it right! Part 3: Investment opportunity vis – a – vis Equity

Sep 27, 2016

-

Advantage Lender: Be the early bird!

Feb 27, 2017