Marketplace Lenders - A disruption to the traditional financial structure!

by Kanika Agarwal

In a recent report published by Deloitte on Marketplace lenders (MPLs), it was attempted to understand the impact of MPLs on banks in a mature market like United States and United Kingdom. MPLs, or Peer-to-peer Lending companies as it is called, in last 10 decades has disrupted the financial landscape. MPLs enable the money to churn in the economy thereby providing interest on idle cash and loan it for debt consolidation, business funding, weddings, etc.

The report primarily addressed the question “Whether or not this disruption will lead to bank disintermediation”, in other words should banks consider MPLs as a threat to their business? Before divulging the conclusion of the report, let’s consider the facts.

It is estimated that the total lending bucket worldwide would be $96 trillion by December 2015[1]. Over a period of time, credit requirement is not going to suppress. Since 2013, the year-on-year growth of the money supply in United States has started to increase[2].Of now, Peer-to-peer lending takes up less than 1% space, $77 billion i.e., a drop of 0.08% in the $96 trillion lending economy.

Banks primarily works on brick and mortar model. Their infrastructure requirement and operational challenges require time and efforts thereby increasing the cost to the end borrowers. In UK, through banks has not announced their results yet, banks are incurring high cost in operations thereby resulting in the decline of revenue by 36%[3]. MPLs work mostly on online business model – the information a borrower requires can be answered in few seconds without making an effort to visit an office, the documents required are in digital format, signatures required are in digital format and the payments are through NEFT, thereby reducing the cost and efforts to the borrowers.

Additionally, the lenders having an excess cash when deposits in bank earn fixed percentage of interest. MPLs provide an opportunity to create and invest in the portfolio they desire.

Nonetheless, MPLs are considered “alternative” source of funding and banks for primary source of funding. Banks are heavily regulated and considered as a risk-free investment. Wall street and financial advisors rely on the transactions with banks principally.

Keeping these arguments in mind, as report rightly concluded, MPLs entrants won’t disintermediate banks in the long run. In fact, both need to breathe in co-existence. Banks cannot service all credit type of borrowers and cannot arrange the funds catered to all the borrowers. MPLs cannot exist without banks’ intelligence and their funds and risk is comparatively high. Banks and MPLs need to work in a coordinated way.

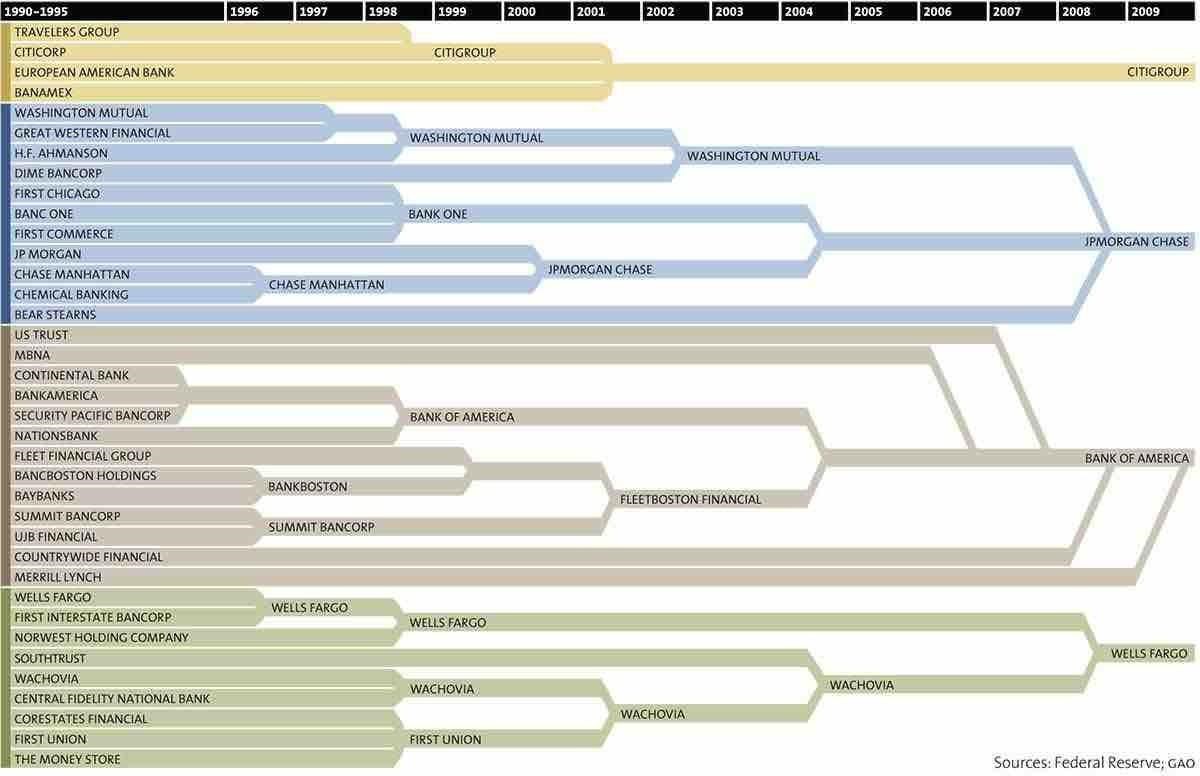

The report also mentions how consolidation and specialization is inevitable in the industry. The banking sector (refer to the image pic1) went through a period of consolidation from 1990 to 2009. MPLs, like banks, will also go through the same.

As rightly pointed out in the report, the players with strong underwriting and servicing capabilities will surpass the competition and will not just survive but also stand tall in the end.

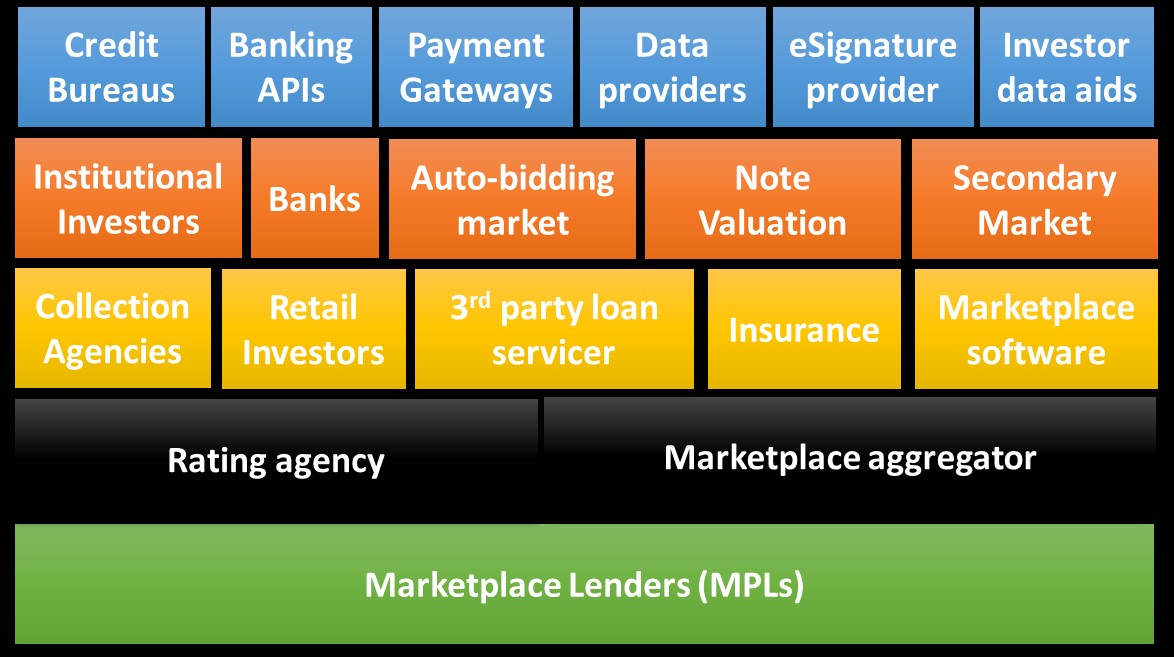

There are questions revolving around the stability of MPL sector as it has not seen any financial crisis as big as subprime crisis. And until it will go through crests and troughs it is difficult to properly answer its sustainability question. With providing millions of people the credit at the right time, MPLs have also managed to create an ecosystem around their business model. (refer to pic 2)

(pic2)

In conclusion the report mentions that three business models – Stalwart MPLs (fewer MPLs, scaled and/or niche), Banks with MPL division (As done by JP Morgan and Goldman Sachs) and Marketplace MPLs (MPLs as white-label Lending-as-a-service model) – will emerge and this seem to be apt considering the historical trend in banking industry as well. Times ahead, will definitely be interesting for this alternative financial industry.

References:

[1] http://www.pymnts.com/in-depth/2015/how-a-rocket-scientist-is-fixing-p2p-lending/.VcQ6UPmqqko

[2] http://www.cato.org/publications/commentary/bank-regulations-continue-hinder-us-recovery

[4] Report, Marketplace Lenders and banks: An inevitable convergence? By Deloitte.

Related Articles

-

Faircent launches Faircent Pro, a co-lending platform for NBFCs & Institutional Lenders

Jun 25, 2022

-

How Fintech is regulated in India?

Nov 25, 2019

-

P2P and Small Business: Bringing Crowd-funding to India

Jul 11, 2016