Why Lenders should embrace the new Auto Invest feature?

As early as 2016 when the P2P lending sector in India was still in its nascent stage and unregulated, Faircent.com realized that going forward, one of the biggest challenges faced by lenders will be cherry-picking quality borrowers. As the online lending sector expands and the pace at which borrowers are listed and funded on the platform increases rapidly, Lenders would need automated support to spread their investments across a large number of borrowers so as to spread risk.

Building a diversified portfolio by investing across borrowers from different backgrounds, risk profiles and loan purpose is a must to earn higher returns. Every Lender tends to build his/her portfolio as per their risk appetite and investment objectives. A lender willing to take more risk to earn higher returns will be more aggressive as compared to a lender content with stable returns at lower risk. Thus, finding the right borrower at the right time which meets a lender’s investment objective continues to be critical to P2P lending. Faircent.com is committed to make this task easier and faster for its lenders.

What is Auto-Invest?

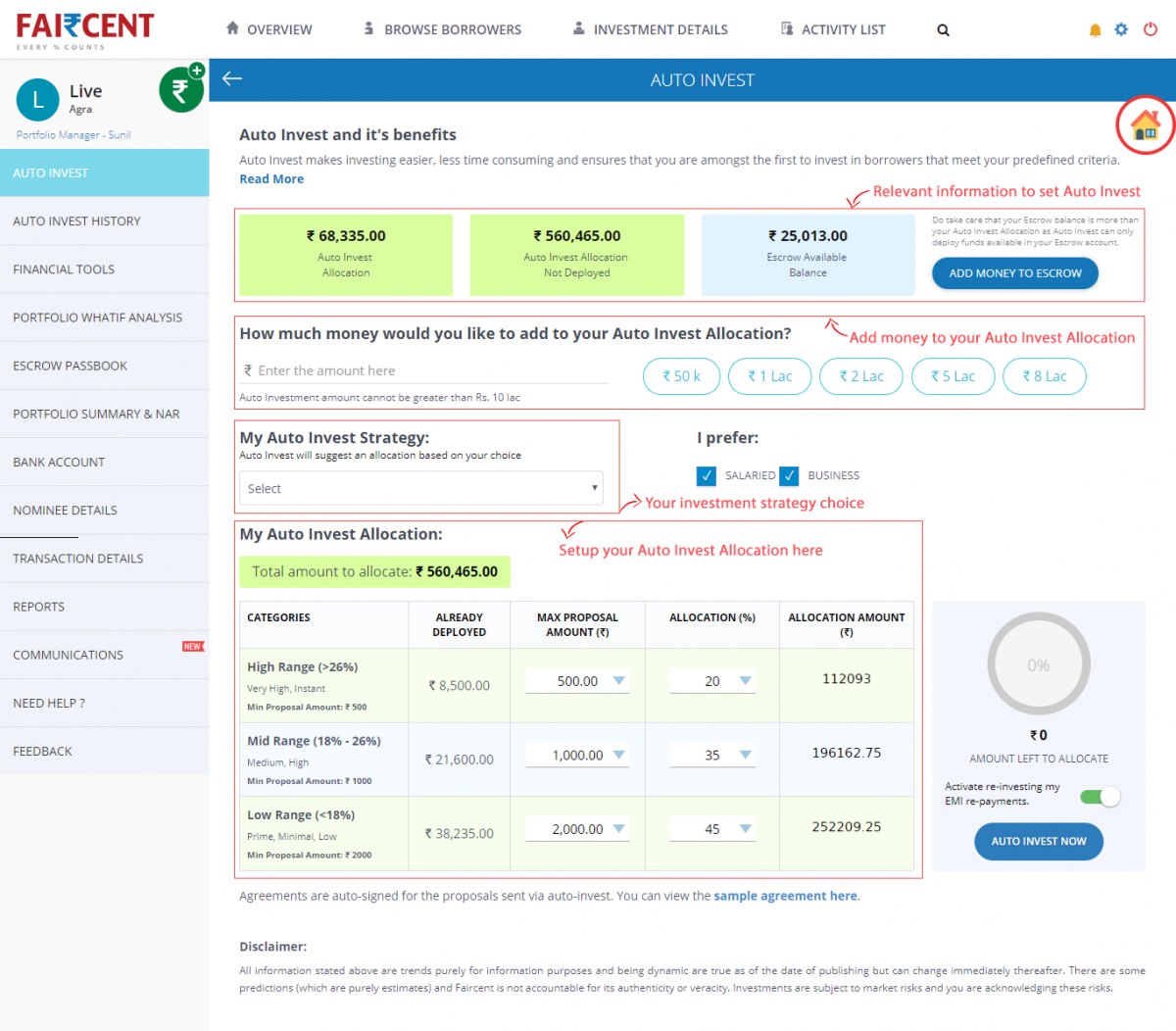

With this objective, Faircent.com introduced a new product variant especially designed to help lenders jump the queue and be the first to invest in borrowers of their choice. Auto-invest is a fully-automated tool that matches the investment objectives of lenders with borrower requirements and sends proposals on their behalf.

Using data analytics and machine learning, 3 investment approach have been configured by the system:

- Aggressive: Auto-Invest allocates the lenders money across loans with potential to deliver higher returns but also at higher risk

- Balanced: Auto-Invest allocates the lenders money across loans with potential to deliver returns at medium risk

- Conservative: Auto-Invest allocates the lenders money across loans with potential to deliver optimized returns but also at minimum risk

Lenders can simply select the approach that best meets their investment objective, and then sit back and relax, while the system sends proposals on their behalf according to selected approach.

Why Auto-Invest?

Auto-Invest ensures real-time investment and funding. Lenders no longer need to spend hours browsing lakhs of borrower profiles listed on the platform to find loans that meet their investment criteria. This is now done on behalf of the lenders by a more efficient fully-automated system that matches the lender’s investment with borrower’s requirement as soon as they are listed, thus saving Lender’s time and effort.

Auto-Invest is based on the 3 fundamental tenets of earning higher returns from P2P lending:

- Diversity: Auto Invest helps spread a lender’s funds across loans at various interest rates so as to build a diversified portfolio faster and in a more efficient manner.

- Fractionalization: Minimum proposal size can be set at as low as Rs. 500/- under auto-Invest. Fractionalization helps lenders invest smaller amounts across a larger number of borrowers thereby spreading their risk and earning higher returns.

- Reinvestment: Reinvestment is a default setting in auto-invest. While a lender can always change the setting, reinvestment of monthly repayments is highly recommended. EMI when re-invested earns further returns that add to the returns already made through the original investment hence giving a compounding effect leading to higher NAR.

Empowering Lenders

Automated investment option at Faircent.com empowers lenders

- Full control over investment

- Approach or max amount per Risk Buckets to be decided by lender

- Build Diversified Portfolio: Enables small investments across many loans

- Jump the queue

- Real-time access to borrowers that meet criteria

- Real-time investment of funds in loans that meet criteria

- Invest Faster with Auto Invest

- Effortless & Time Saving

- Manual Log-in and browsing for borrowers not required

- Flexible

- Option to Pause or Cancel Auto-Invest

- Modify criteria whenever required

- First In – First Out

- Borrowers will be first funded by Auto Invest and any balance requirements will be transferred to manual funding

- Credit-worthy borrowers are much in demand, requiring faster funding which will be met by Auto Invest

Related Articles

-

A Definitive Guide to Loans

May 31, 2018

-

7 Ways to Beat Inflation

Apr 11, 2014

-

The Product Management Team - Striving For The Customer: Part 2

May 09, 2016