P2P Lending Platforms ask Finance Ministry to increase Credit Limit

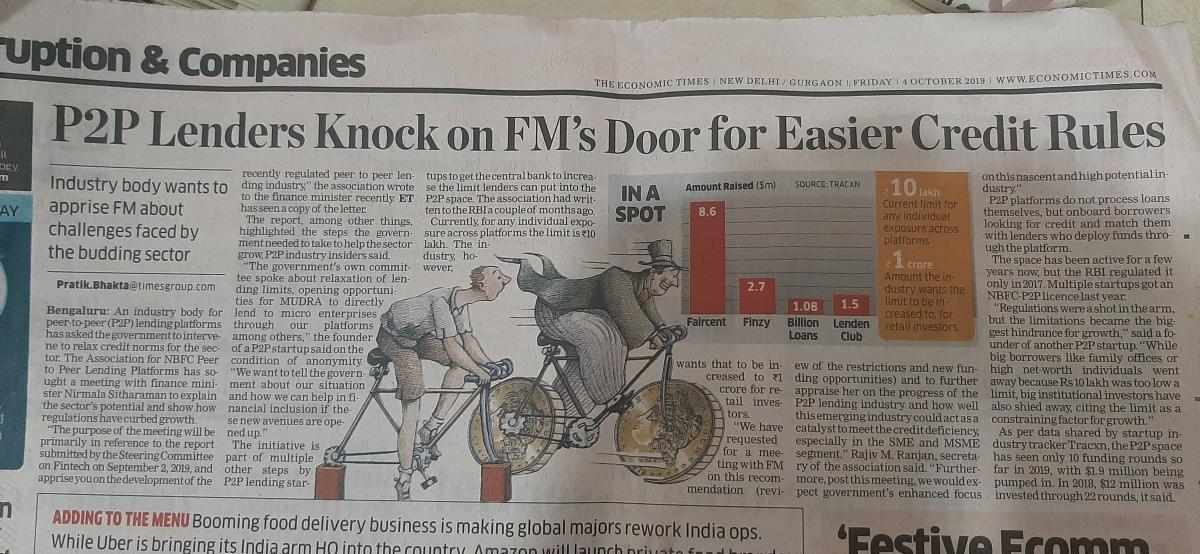

An industry body for peer-to-peer (P2P) lending platforms has asked the government to intervene to relax credit norms for the sector. The Association for NBFC Peer to Peer Lending Platforms has sought a meeting with finance minister Nirmala Sitharaman to explain the sector’s potential and show how regulations have curbed growth.

“The purpose of the meeting will be primarily in reference to the report submitted by the Steering Committee on Fintech on September 2, 2019, and apprise you on the development of the recently regulated peer to peer lending industry,” the association wrote to the finance minister recently.

“We have requested for a meeting with FM on this recommendation (review of the restrictions and new funding opportunities) and to further appraise her on the progress of the P2P lending industry and how well this emerging industry could act as a catalyst to meet the credit deficiency, especially in the SME and MSME segment,” Rajiv M. Ranjan, secretary of the association said. “Furthermore, post this meeting, we would expect government’s enhanced focus on this nascent and high potential industry. Earlier the association had written to RBI highlighting their grievances. P2P platforms have demanded a relaxation of the guidelines for credit limits issued in 2018. The current limit for all peer-to-peer credit loans is INR 10 Lakh

Click here to read more

https://inc42.com/buzz/p2p-lending-platforms-turn-to-finance-ministry-over-credit-limit/

Related Articles

-

Appy Lending

Jun 30, 2016

-

Indian Demonetization & Rupee Reform: The Uber Moment Fintech Needed?

Jan 02, 2017

-

RBI for treating peer-to-peer lending platforms as NBFCs

Apr 29, 2016