Is your financial adviser recommending P2P Lending?

The Indian peer to peer (P2P) lending industry has grown at a phenomenal rate in the last year. While many have embraced it as a new asset-class for investors to earn healthy returns on their idle money, many financial advisers are still in wait and watch mode. Mainly because it’s a new, risk-based asset class about which awareness is low.

While P2P lending in India is still in nascent stage and has not seen a recession, if the economic uncertainty and upheaval of last few years, wherein the industry has thrived, are anything to go by, many feel that it can withstand the test of time. After all, money lending is one of the oldest profession. Also, economic downturn does not mean that there is no protection for lenders. The loan agreement is directly between the lender and the borrower and is enforceable in court of law. Recession will not affect one asset class more than others. All market-linked investments from stock market to mutual funds are equally susceptible to this risk.

Since peer to peer platforms tend to offer higher returns than other asset class, they are considered riskier. However, worth considering is that P2P loans are based on mutually-agreed upon legal agreement between the lender and borrower. Hence, they deliver a predictable return. And while there is a risk that loans may default, this risk can be managed within an expected default range with careful planning. Lenders can mitigate risk by carefully evaluating and building a diversified portfolio.

In fact, one of the advantage offered by P2P lending over traditional market-linked investments is that the returns offered are fixed and not susceptible to market turbulence. Further, P2P lending is like investing in debt; the capital risk is lower, and there exist ways to mitigate it. In case a loan is defaulted upon, investors can pursue legal recourse against the borrower. Such a provision is not possible by investing in stocks and bonds. By diversifying investment across different borrowers, a lender’s portfolio begins to mirror the overall default rate of the platform, gaining stability and consistency and enjoying returns just like a bank does.

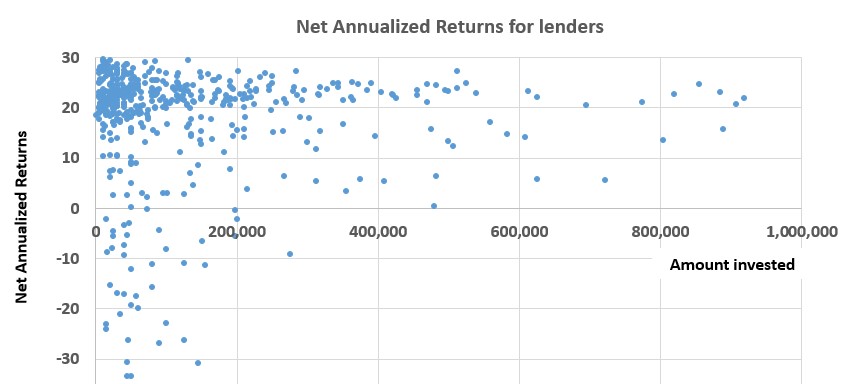

P2P lending is consistently delivering net returns upwards of 18% p.a. As per the latest Faircent.com Research & Analysis Report April 2017, a diversified portfolio with investments of 5 lacs and above can stabilize at 18% to 22%.

Add to this the fact that since Borrowers repay every month (principal & interest), there is a steady cash flow coming in every month. Reinvesting this monthly inflow means an opportunity to earn even greater returns. The report clearly shows, that an increase in reinvestment has also lead to enhanced net annualized returns for the lenders owing to the engagement and diversification benefits.

All Data Source: Faircent.com Research & Analysis Report April 2017

It is time financial advisers explore the whole new world of P2P lending and the benefits it can offer to their clients – fixed and higher returns with predictable risk and opportunity to build a diversified portfolio of investment opportunities. As per ORCA estimates, by 2020, 2.7 million people, globally, will be P2P lenders. Will you be one of them?

Related Articles

-

How borrowers are exploited by banks

Oct 16, 2017

-

How P2P lending will boost small business sector in India

Dec 11, 2017

-

How can P2P sites guard against bad loans

Jun 06, 2016