COVID Low Impact Zone Coding on Faircent

Faircent has started a new loan offering to help small businesses and individuals access credit in districts across India which have suffered low to nil impact of COVID-19 outbreak.

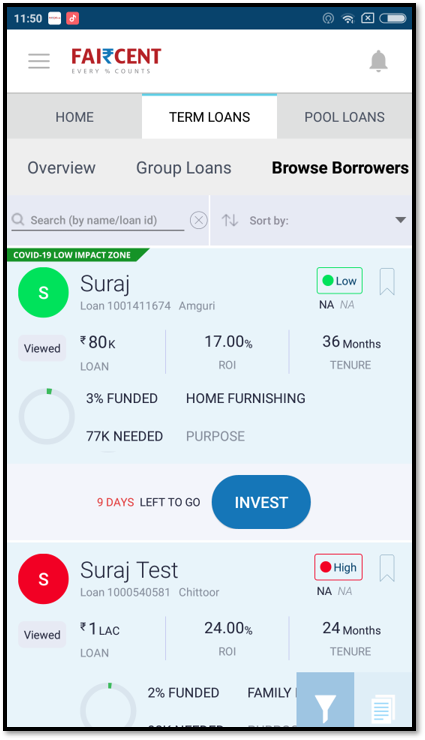

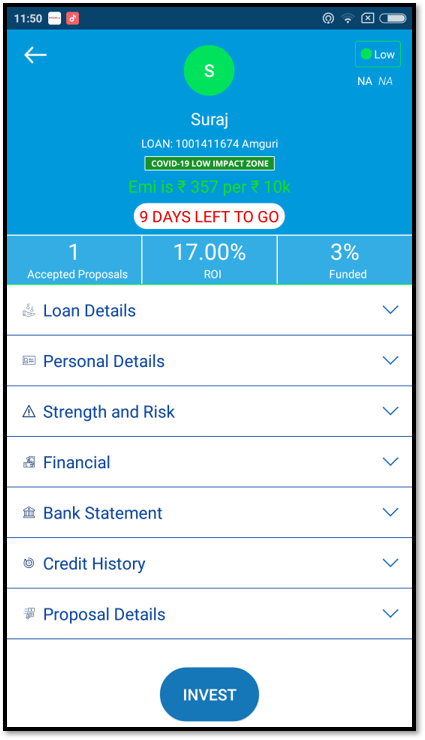

The loan targets retailers, small business owners and salaried professionals facing short-term financial constraints caused by the lockdown in areas identified as the green zones – where there have been not more than 10 COVID-19 positive cases. These borrowers will be easily visible to the lenders on their dashboard through a green color-coded tagging # COVID-19 Low Impact Zone.

There are many districts and zones in India that are unaffected by COVID-19 or have witnessed very few cases. These clusters are expected to return to normalcy much faster. Keeping this in mind, Faircent has adopted a targeted approached towards onboarding borrowers residing in these zones on a priority basis along with quick disbursal of funds.

Related Articles

-

5 ways to reduce risk in P2P Lending

May 21, 2019

-

How To Live The Luxe Life!

May 03, 2016

-

Celebrating Women Borrowers

Apr 07, 2021