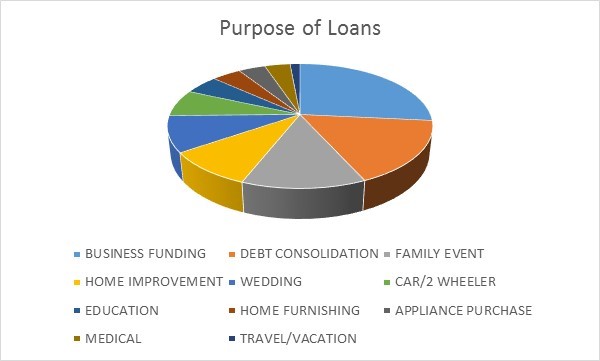

As the number of peer-to-peer (P2P) lending platforms increase and along with it the number of borrowers and lenders, one wonders what kind of loan is suitable for a P2P site. There are a number of loans that can be raised through such platforms and the most popular ones are:

Loan disbursal on basis of disbursal on Faircent.com. View more statistics by clicking here

- Business funding- The most popular loan segment on a P2P site is to fund a business. This is due to many reasons; all intrinsically linked to the advantage P2P loans provide. Business loans are uncannily difficult to raise from banks or other financial institutions. While banks have elaborate financing schemes, especially for business, it is not easy to apply for one, takes months to get processed, is cumbersome and often needs collateral. P2P lending platform works out perfectly for someone who needs to quickly raise money. Business needs often cannot wait and P2P platform can help get over the shortfall in money within a few days. At Faircent, business funding has been the most popular category with about 27% of our total loan disbursements being in this category.

- Debt consolidation- Debt consolidation is when someone has multiple outstanding liabilities like car loans or credit card outstanding and now wants to simplify things. Having more than one debt to handle is often tough. Keeping track of different due dates, amounts, and different bank accounts can often prove to be a hassle. Debt consolidation helps you fold all your debt into one and then service that one outstanding loan. Both personal loans and credit card outstanding carry a very high rate of interest. P2P loan is particularly attractive for debt consolidation because interest rates are more reasonable and multiple high interest loans can be substituted with one low interest loan. Since our inception, about 17 % of our total loan outgo has been to people looking to consolidate their debt.

- Family event – There are many events in our life when we need extra money to conduct the affairs smoothly. Events such as a newborn or a death in the family, friend or relative’s wedding or child’s first birthday can often lead to a situation where one needs a loan due to a temporary shortfall in money. The amount in question is often low, but one often needs the money fast. Traditionally, such funding can be met only through a personal loan which have very high interest rates. Comparatively, P2P loans are faster and interest rates are often lower. Data shows that as much as 13% of all loans disbursed on Faircent belongs to this category.

- Home improvement - Anything from decoration, painting, renovation, furnishing, changing the look of your home, tiling, flooring, plumbing that needs to be carried out in your house, can be funded by a loan. However, the paperwork involved in securing loans from banks makes it a daunting task. Apart from furnishing plans and bills provided by a certified architect, keeping the said property as a collateral; those living in high-rises also have to provide a no-objection certificate from the housing society and the local municipal corporation. Even after all this, most banks only finance up to 80 per cent of the renovation cost and the balance has to be borne by the customer. This is where P2P lending provides the option of securing full amount of funding in a faster, smoother manner with less paperwork.

- Wedding – Weddings are a costly affair in India and across the world. For youngsters looking to tie the knot, it often becomes difficult to fund their wedding ceremony. Personal loans from banks have been the overwhelming choice, but people are increasingly looking at P2P platforms to fund weddings. P2P loans have a far lower rate of interest and it makes perfect sense to avail one. Along with home improvement, we see about 9% of our borrowers taking a loan for wedding.

- Car or two-wheeler – P2P platform is also ideal for people looking at buying a car or a two-wheeler. P2P loans can be secured within a few days and unlike, traditional bank loans, it allows funding of almost the entire value of the car with accessories. P2P loan allows you to the flexibility to raise as much as you need, as long as it is within what we consider is your “repayment capacity”. Popular on Faircent, about 7 % of our borrowers take a loan to buy a vehicle.

Beyond the above mentioned reasons, P2P loans are also ideal to fund one’s education and purchasing consumer durable products (appliances). In fact, except a loan to buy a house (mainly since funds required for this are substantial), almost every other loan is fit for a P2P platform. As awareness about P2P loans increase, we will see further growth in each of these segments.

Sign Up here if you need funds for any purpose, because every % counts!