Is your house looking less of a home and more of a dumping ground? Do the walls look jaded? Have the cupboards lost their sheen? Is the living room a sad and sorry shadow of its former self? Does the upholstery give you an eye-sore? In other words, is your pad crying for attention? If so, then it’s time to get your act together and spruce up your immediate habitat.

Maintenance Made Easy

Like our car, a house, too, needs regular maintenance. However, unlike the former, taking care of a house can cause a big dent in our finances. Painting, replacing broken fixtures, remodelling the study, changing the living-room decor and restoring the tiling – basically, the works – don’t come cheap.

While you can probably pick up the tab for the small jobs yourself, you may need some extra money to go in for a refurbished home. If you are wondering where that additional money is going to come from, worry not. About 12% personal loans disbursed by Faircent over the last 18 months has been to finance home improvement and home furnishings. In fact, these combined are amongst the top 3 reasons that borrowers are borrowing on Faircent.com.

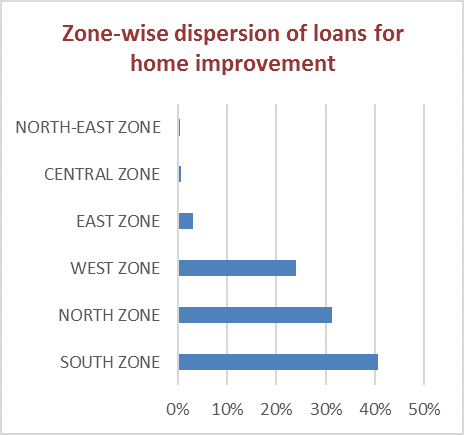

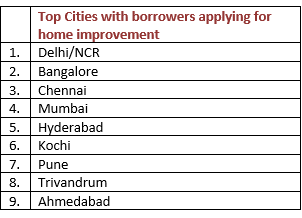

It seems that home owners from the southern cities combined – Bangalore, Chennai, Hyderabad, Kochi and Trivandrum – followed by the Delhi and NCR are most keen to refurnish or renovate their homes. This trend co-relates to the cities with highest real estate growth in the recent past. This is further validated by cities rating high on this criteria in the West zone – mainly Pune and Ahmedabad.

Spending an Extra Buck

Though most banks provide home improvement personal loans, at an interest rate that ranges between 11 -15 per cent, and some also provide funds for purchasing furniture. (The processing fee adds another 1% approx. and the pre-payment charges are about 2%)

However, the paperwork involved in securing personal loans from banks makes it a daunting task. Apart from furnishing documents and bills provided by an architect, banks also seek the account statement for the past six months. Other mandatory documents include KYC (Know Your Customer) forms and property papers. For those living in high-rises and wanting to revamp their homes, banks also require a no-objection certificate from the housing society and local municipal corporation.

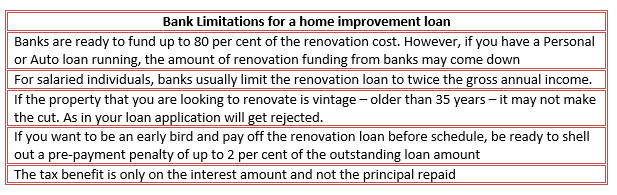

Also, most banks usually finance up to 80 per cent of the renovation and the balance has to be borne by the customer. Additionally, the final amount sanctioned by the bank depends on the sum quoted by a certified architect, your repayment capacity, and the total worth of the property. (refer to the box).

Fair and Square

If the above process sounds intimidating, don’t fret. If you don’t want to bank upon a bank for funding, you could consider signing up with a Peer-to-Peer (P2P) personal loan facility like Faircent.com. It is less cumbersome and involves less paperwork and credit worthy borrowers can get easy personal loans at lower or comparable interest rates. The paper work is similar to any other personal loan and we do not require property papers, approval from architect or housing society. For credit worthy borrowers, the entire fund amount can be approved for funding and the P2P loan rate starts at 12% with no pre-payment charges and flat processing fees. (refer to the box) Sounds too good to be true. Register now! Because every % counts.